Ear September 2025, AI technology has experienced "high cuts and lows", and funds are moving from pure AI computing power track with excessive growth in the previous period to those with physical carriers and landing scenarios with physical carriers and landing scenariosPhysical AI (humanoid robot)D9DD5;">Direction migration.

is the rise of the so-called "embodied Intelligence": an agent must learn and evolve through interaction with the physical world. The current form that is closest to the human living environment ishumanoid robot.

Not a four-legged dog, not a wheeled car, nor a robotic arm—but a "humanoid machine" that can walk, bend and grasp.

Today, robot concept stocks strengthened again, Wolong Electric Drive hit the daily limit, Shangwei New Materials, Yidelong and others followed suit, and the sector's popularity continued to heat up.

So at the moment, what is the overall investment for the humanoid robot sector? Is it worth paying attention to?

Question 1: Why is it now?

Artificial intelligence has been developing for decades, and most of the time it is just "seeing" and "saying".

GPT can write poems, and Stable Diffusion can draw, but they can't do the job - they can't screw screws, carry boxes, and help the elderly get up.

At present, the rise of the so-called "Embodied Intelligence", an agent must learn and evolve through interaction with the physical world.

The current form closest to the human living environment isHumanoid robot.

This choice is not based on romanticism, but the optimal solution under the constraints of reality.

So when the AI model has the ability to understand the basic ability, the next step is naturally to "walking down the ground".

So, Optimus appeared, Yushu's H1 danced, and "Yanyang BOT" was on the Spring Festival Gala - these are not isolated events, but signal flares for technological paradigm migration.

Question 2: Who is pushing?

The main engine of this round of humanoid robot comes from car companies, especially Tesla.

Automatic cars above level 3 are essentially "four-wheeled robots", which require sensing the environment, planning the path, controlling the actuator, and responding to sudden disturbances.

These abilities share the same set of underlying logic as bipedal walking robots:Status estimation + motion control + real-time feedback.

Tesla's advantages are:

1. It has developed its own FSD chip and Dojo supercomputer.

2. Have a visual perception system trained with massive amounts of real driving data.

3. Master the capabilities of integrated die-casting, three-electric systems, thermal management and other vehicle engineering.

4. Musk himself firmly believes that "general robots" are a bigger ending than electric vehicles.

Musk clearly stated in the "Chapter 4 of the Macro Plan" released in September 2025: "In the future, 80% of Tesla's value will come from Optimus."

In addition, Yushu, Zhiyuan, Huawei and Xiaomi are also accelerating their promotion.

Question 3: Is there a market? The demand is real

Let's face it, the humanoid robot will not enter your living room in the short term.

Home service scenarios have extremely high requirements for security, reliability, and interaction capabilities, and are price-sensitive

But the B-end market is different.

Optimus has tried to complete battery pack handling in Tesla's factory;

Yushu H1 inspected the BYD workshop;

Zhiyuan Robot participated in production line assembly testing in Lingang, Shanghai;

In the medical field, Fourier's rehabilitation exoskeleton has been tried in several hospitals.

More importantly, the order structure has changed.

Since 2025, there have been many procurement contracts in the robot industryProcurement contracts of tens of millions or even billions of yuan, the purchaser is no longer limited to universities and scientific research institutions, but extends to logistics parks, municipal services, and industrial parks.

According to the Forward Industry Research Institute, by 2029, the scale of China's humanoid robot market will reach 75 billion yuan, with a global scale of 32.4 billion US dollars.

Morgan Stanley is more radical:The global deployment volume may reach 1 billion units in 2050, corresponding to a market size of over 5 trillion US dollars.

III. Return to investment

Reviewing the history of A-shares, every round of large-level industrial trends:

2020: Power batteries and new energy vehicles

2021: Photovoltaics and Energy Storage

2023: Optical Modules and AI Computing Power

Now, the robot sector may be standing at a similar historical node.

In the first half of this year, 120 A-share listed companies achieved a total net profit attributable to shareholders21.618 billion yuan, a year-on-year increase of 13.72%.

especially, the profit in the second quarter reached 11.367 billion yuan, an increase of 16.80% year-on-year growth rate, with solid performance growth and improved order visibility.

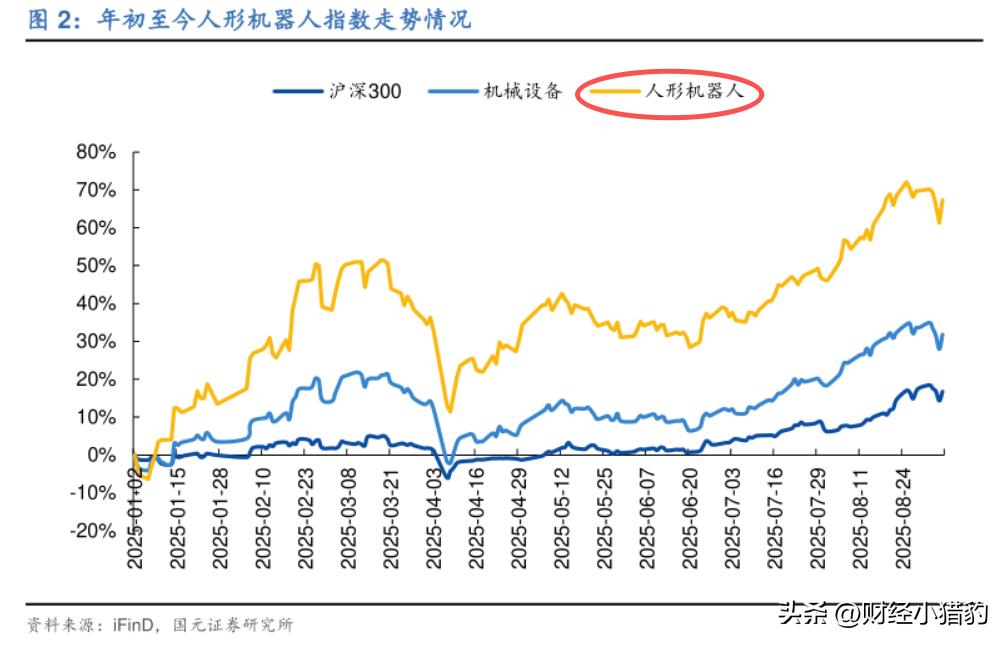

From the market performance, the robot index has increased since 202528.51%, rising since the second half of the year17.61%, it has approached a record high.

Once the effective breakthrough is made, a wave of main upward wave may be started.

More importantly, humanoid robots represent not only the upgrade of a single product, but the reshaping of production relations.

Last

Today's robotics industry, like electric vehicles in the early 2010s, has controversy, bubbles, and losers, but it also breeds the direction of the next era.

Although the technical route has not been unified, the supply chain is still polished, and there is still uncertainty in the commercialization path, the trend may have been clear.

Special statement: The above content does not constitute any investment advice, guidance or commitment, and is for academic discussion only.

If you think the information is useful, I hope you can support it. Once you like, forward, and share it casually are all the motivation for the little cheetah to persist~